24/03/2022

Moving into your second home and stepping up the property ladder can be just as daunting as buying your first home. While you may have built up equity and understand the buying process more than first-time buyers, there are still some things you need to know.

There are many reasons why you may be looking to move up the property ladder now. Perhaps you’ve outgrown your current home, want to relocate to a new area, or are now in a position to buy a more expensive property?

Deciding to step up the property ladder can be exciting, but it can be stressful too. Getting to grips with the process and setting out your priorities first can make it smoother.

Most second-time buyers will still be using a mortgage to purchase their next home. These five questions can help you find the right mortgage and weigh up the costs of moving.

1. Could you port your current mortgage?

If you are happy with your current mortgage, you may be able to retain the interest rate terms by porting it. This is often done if you have a favourable interest rate or if you’re ready to move before your mortgage deal ends. You will still need to apply for a new mortgage with your current lender.

It’s not always possible to port your mortgage or borrow more through it, but it’s worth checking with your lender. You should expect to pay some fees to port your mortgage, so make sure you understand these first. You should also look at what other deals are on offer, as taking out a new mortgage deal with a different provider could be cheaper in the short and long term.

2. How much deposit will you put down?

As a second-time buyer, you will usually have built up equity in your current home. This means you may be able to put down a larger deposit than you did when buying your first home. You’ll likely have repaid some of your loan and the value of the property may have increased too. According to the Halifax House Price Index, the average house price increased by 9.8% in 2021.

Keep in mind that deposits are calculated as a percentage of the total property value. So, while you may be putting down a larger sum, you will still need to consider the loan-to-value (LTV) ratio.

You will usually need a deposit of at least 10%, although there are some 5% deals available. The lower the LTV, the more competitive the interest rate you’ll typically be offered. There may also be reasons to retain some of the profits from the sale of your first home, for example, to carry out renovation projects in your new home.

How much you’ll place down as a deposit will usually be linked to the sale price of your home, so be realistic about how much your current property is likely to sell for.

3. How long do you want your mortgage term to be?

Traditionally, homebuyers took out a 25-year mortgage and would own their home outright after these 25 years. However, as homes have increased in price, some buyers have taken out longer mortgages and you have the option to change the term of the mortgage when you take out a new deal. Moving up the property ladder is a good time to assess how long you want to pay your mortgage for.

Increasing your mortgage term can make monthly repayments more affordable, as the cost is spread out over a longer period, but the total amount of interest paid will be greater. In contrast, shortening the mortgage term will increase your monthly payments but mean you pay less interest over the full term.

4. Will your new mortgage repayments still be affordable?

If you’re planning to purchase a more expensive property, assessing your affordability is important. Will you still be able to keep up with repayments?

Mortgage lenders will also assess your affordability when you apply for a new mortgage. As someone moving up the property ladder, you may be able to demonstrate that you can reliably meet mortgage repayments to lenders. However, the lender will also review your income, outgoings, and how you’d cope with an interest rate rise just as they did when you bought your first home.

Lenders will also use your credit report to assess how risky lending to you is. So, going through your report to ensure it’s accurate and highlighting any potential red flags is a step you should take.

5. What additional costs will you face?

When selling and buying a home to move up the property ladder, you will face additional costs.

You may need to pay estate agent fees and mortgage fees. As you will be both selling and buying a property, you should expect conveyancing fees to your solicitor to be higher than when you were a first-time buyer too.

Other costs you should budget for include legal fees, valuation costs, redemption costs if applicable, moving expenses, and more. Make sure you create a realistic budget when moving home and have a buffer in case some costs are higher than you expect.

If you’re hoping to buy your second home, you may not have paid Stamp Duty the first time. Stamp Duty is paid when you buy property or land over a certain price in England and Northern Ireland. There are similar taxes in Scotland and Wales.

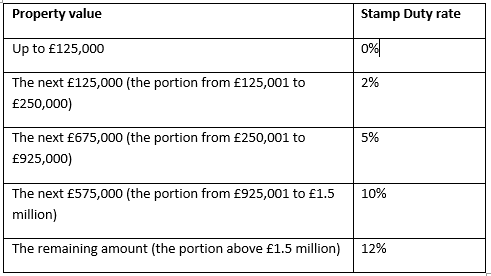

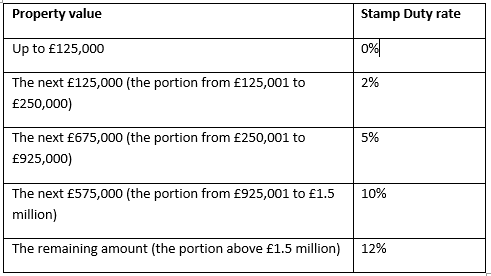

The rate of Stamp Duty you will pay will depend on the value of the property.

Source: Gov.uk

The above rates are accurate as of March 2022 but are subject to change in the future.

According to the Halifax House Price Index, the average property in the UK is now around £275,000, which would mean a Stamp Duty bill of £3,750. You must pay Stamp Duty within 14 days of buying a property, so it’s important to make the costs part of your budget.

If you’re ready to move up the property ladder, please contact us. We can help you secure a mortgage and make the process of buying your second home as stress-free as possible.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.