Wednesday 4 August 2021

In a bid to keep the property market moving, chancellor Rishi Sunak introduced a Stamp Duty holiday a year ago. It led to property prices soaring but, as the holiday comes to an end, what does it mean for the property market?

When purchasing property in England and Northern Ireland, you usually pay Stamp Duty. Similar property taxes apply in Scotland and Wales.

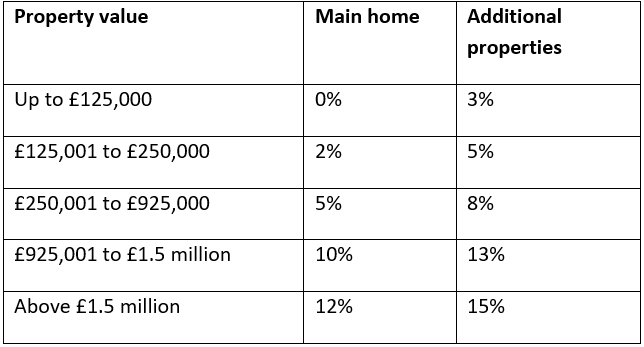

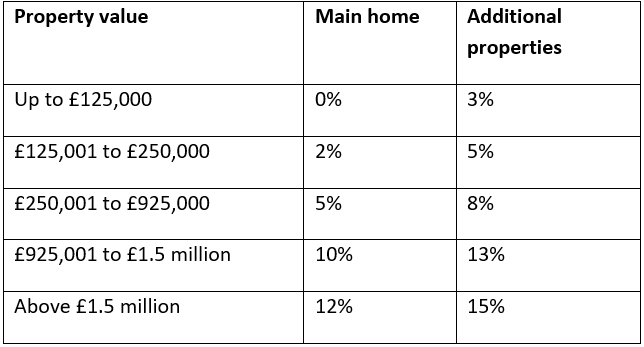

The threshold for paying Stamp Duty is normally £125,000 for residential properties, rising to £300,000 if you’re a first-time buyer. The amount due will depend on the value of the property you’re purchasing. The standard rates of Stamp Duty in England and Northern Ireland are:

However, in the last 12 months, buyers have benefited from savings of up to £15,000.

During the first Covid-19 lockdown in spring 2020, the property market, along with many other sectors, ground to a halt. To encourage property transactions, the chancellor introduced a Stamp Duty holiday. It meant no tax was due on the purchase of main homes worth up to £500,000 between 8 July 2020 and 30 June 2021. Those purchasing second homes or buy-to-let investments also benefited from reduced rates.

From 1 July 2021 to 30 September 2021, there will be a transition period before Stamp Duty rates return to normal on 1 October 2021. During this time, the nil-rate band for Stamp Duty will be £250,000.

Was the Stamp Duty holiday a success?

If the holiday aimed to keep property transactions moving throughout the pandemic, it’s certainly been a success.

In March 2021, Bank of England statistics show net mortgage borrowing reached £11.8 billion, the highest level recorded since the series began in April 1993. November 2020 also represented a peak for house purchases, with more than 103,000 transactions taking place.

As demand soared, house prices inevitably began to rise too. The Halifax House Price Index shows house prices have increased by 9.5% in the space of just a year, taking the average property price to £261,743.

Thousands could find they face an unexpected bill due to delays

With transactions reaching a record high, the property market is under considerable pressure. As a result, some home buyers have faced delays and could now find they don’t complete in time to take advantage of the Stamp Duty holiday.

Whether it’s delays with lenders, conveyancers, or surveyors that have affected the house buying process, it can be frustrating at the best of times and could now mean buyers need to find additional money to pay the tax.

A petition has been set up calling for the Stamp Duty holiday to be triggered upon exchange of contracts rather than completion. If this were introduced, it could save buyers facing delays thousands of pounds.

Will the end of the Stamp Duty holiday mean house prices fall?

There’s some debate about how the end of the Stamp Duty holiday will affect the property market. While some reports suggest that house prices will fall, experts believe other factors will prevent this from happening.

According to the Guardian, Andy Haldane, the Bank of England’s chief economist, described the property markets as “on fire”. He said he still expects to see high demand, especially as some households have increased their savings during lockdown.

Haldane also noted that low interest rates are set to remain in place. This provides aspiring first-time buyers and home movers with access to competitive borrowing that could make it easier for them to purchase a new home.

On top of this, Halifax adds lifestyle changes could continue to drive demand in the coming months. Homeowners are looking for bigger properties as they seek more space to work from home long term. It’s a lifestyle shift that “might warrant an increased willingness to spend a higher proportion of income on housing,” says the lender’s managing director, Russell Galley.

The combination of these factors means it’s unlikely that house prices will start to tumble when the Stamp Duty holiday ends. Yet, demand and house price rises could begin to level off.

In January, as the original end of the Stamp Duty holiday approached, the Royal Institution of Chartered Surveyors (RICS) found buyer enquires declined by around 28%. However, new listings also fell by around 38%, so demand continued to outstrip supply. If you’re looking for an opportunity to snap up property when prices fall, you may need to reassess your plans.

If you’re planning to buy property in the coming months, whether as your main home or as an investment, we can help you find the right mortgage for you and offer guidance throughout the property buying process.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home maybe repossessed if you do not keep up repayments on your mortgage.