If you’re a landlord, your outgoings may have increased this year thanks to rising interest rates and could climb further. It’s essential that you review your cash flow and the effect it could have on long-term plans.

A combination of factors, including the Ukraine war and the after-effects of the Covid-19 pandemic, means inflation is high. In the 12 months to August 2022, inflation was 9.9%.

In response to this, the Bank of England (BoE) has increased its base interest rate several times. In September, the rate increased to 2.25%. If you took out a mortgage to purchase a buy-to-let property, your repayments are likely to rise.

How rising interest rates could affect your mortgage repayments

If you have a variable- or tracker-rate mortgage, your repayments may already have changed. If you have a fixed-rate mortgage, it’s likely your outgoings will increase when your current deal ends.

As most buy-to-let mortgages are interest-only, even a small increase to the rate could affect your outgoings and how profitable a property is.

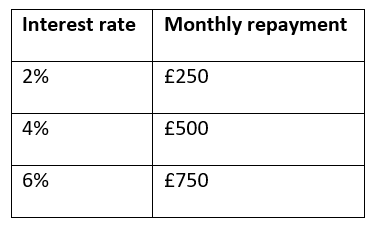

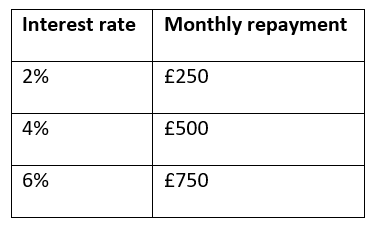

If you borrowed £150,000 through an interest-only mortgage, the below table demonstrates how changing interest rates would affect you.

Source: Money Saving Expert

The BoE expects inflation to peak at around 13%, and it’s likely to make further changes to the interest rate in the coming months.

As this could affect your outgoings significantly, you should review your cash flow. How much could your mortgage increase before the property is no longer profitable?

Research from estate agents Hamptons suggests that if mortgage rates reached 5.6%, the average buy-to-let would lose money.

With one of your largest outgoings predicted to rise further, you may consider increasing the rent to bridge the gap.

Zoopla statistics suggest this is something many landlords have already done. At the start of 2021, average annual rental growth reached a 14-year high, with average rents increasing by £88 a month when compared to a year earlier.

Make sure you speak to a local estate agent first, as demand for rental properties can vary across the country. An estate agent will provide a guide for the rental yield your property could achieve.

As well as affecting your cash flow now, higher mortgage costs could affect your long-term plans. For example, if you plan to use the income for retirement or use the profit to pay off the mortgage debt, you may now need to reassess.

2 other ways high inflation could affect landlords

It’s not just mortgage repayments that are being affected by high inflation. Here are two other areas you should consider as a landlord.

1. Higher maintenance costs: At times, your property will need maintenance work carried out. In many cases, costs have increased for both materials and labour. So, if something needs repairing at your property, it’s now likely to cost more. Reviewing how you’d pay for necessary maintenance could highlight a gap as costs rise.

2. Greater risk of arrears: Families are facing increased pressure on their budget and there’s a risk the economy could fall into a recession. As a result, there’s an increased chance that some tenants will be unable to pay their bills. If this happened, would your insurance cover arrears?

Could you secure a better mortgage deal?

If your mortgage deal is coming to an end, you may be able to secure a better deal.

Switching to a mortgage with a lower interest rate could save you money and mean that your buy-to-let property is more profitable.

There are lots of mortgage lenders to consider and it’s not just the interest rate you’ll pay that’s important. Depending on your circumstances, you may also want to consider the mortgage fee, term or flexibility.

If you’re ready to search for a new mortgage deal, please contact us. We’ll help you find the lenders that suit your needs and offer guidance throughout the application process, including explaining what the interest rate will mean for your repayments.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Buy-to-let and commercial mortgages are not regulated by the Financial Conduct Authority.

Your home may be repossessed if you do not keep up repayments on your mortgage or other loans secured on it.